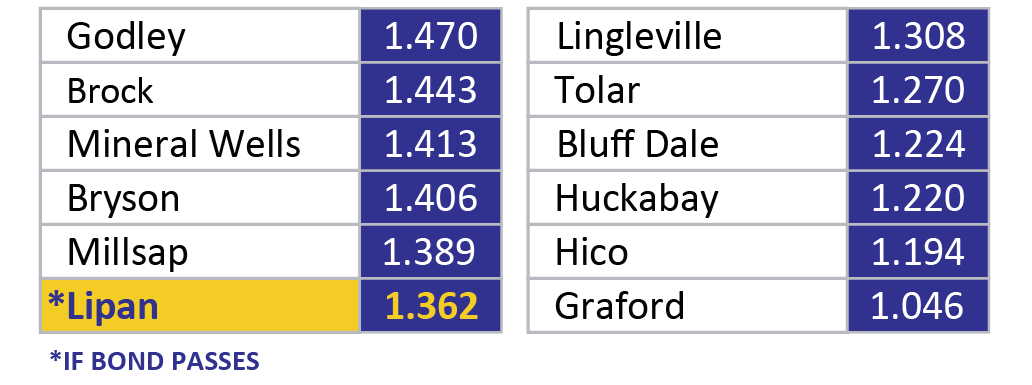

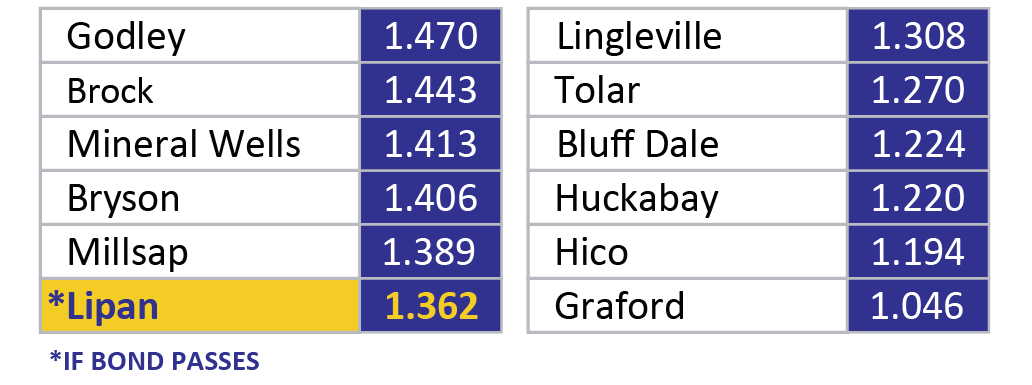

| Year | M&O Rate | I&S Rate | Total |

|---|---|---|---|

| 2019 | 1.0700 | 0.3000 | 1.3700 |

| 2020 | 0.9630 | 0.3000 | 1.2630 |

| 2021 (proposed) | 0.9630 | 0.3990 | 1.3620 |

| Market Value | Homestead Exemption | Taxable Value | Annual Increase | Monthly Increase |

|---|---|---|---|---|

| $100,000 | $25,000 | $75,000 | $75.00 | $6.25 |

| $200,000 | $25,000 | $175,000 | $175.00 | $14.58 |

| $300,000 | $25,000 | $275,000 | $275.00 | $22.91 |